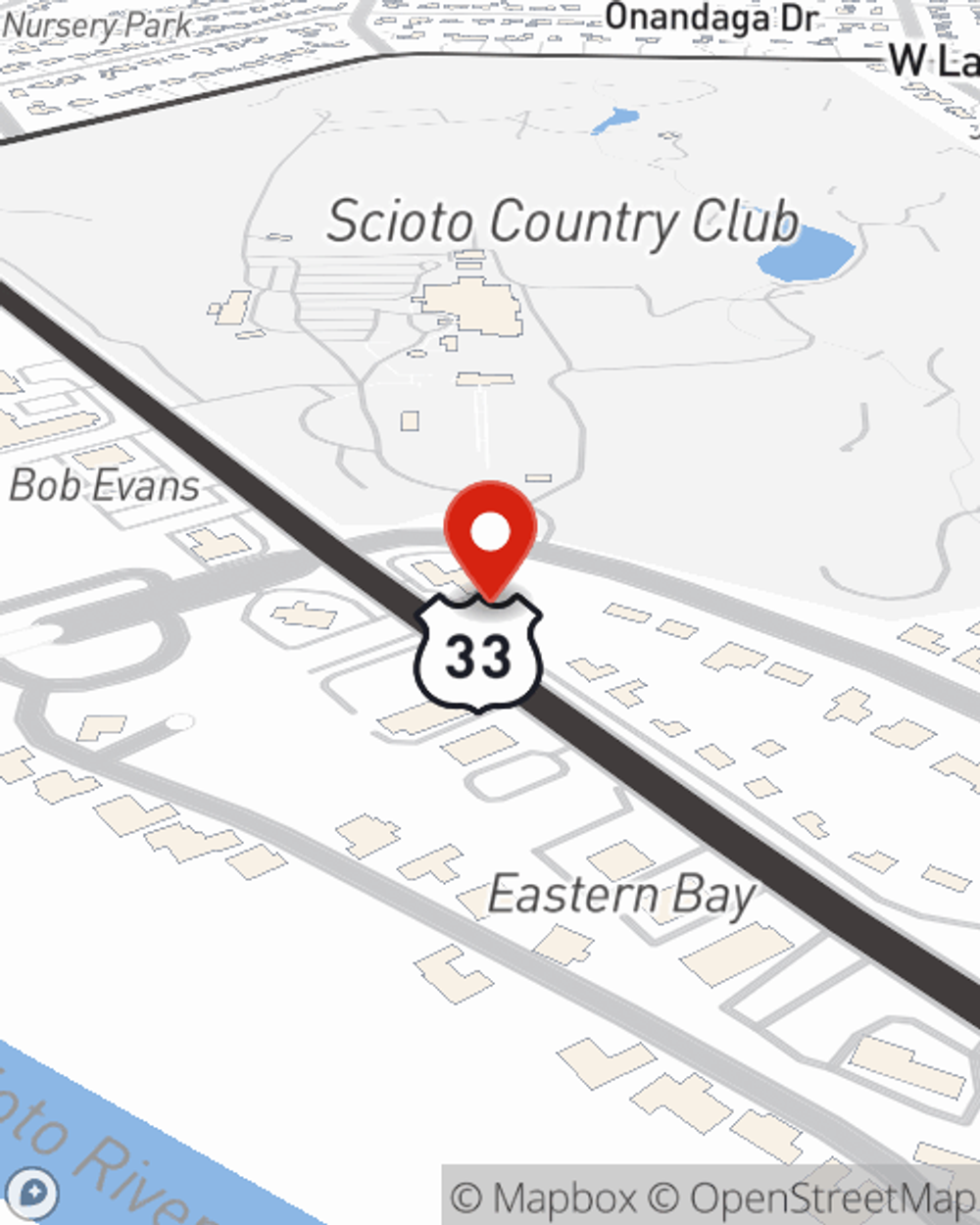

Business Insurance in and around Columbus

One of Columbus’s top choices for small business insurance.

Cover all the bases for your small business

- Columbus

- Upper Arlington

- Hilliard

- Dublin

- Worthington

- Bexley

- Grove City

- Powell

- Westerville

- Gahanna

- White Hall

- Reynoldsburg

- Blacklick

- Franklin County

- Delaware County

- Madison County

- Pickaway County

- Delaware

- Marysville

- Pickerington

- Pataskala

- Fairfield County

- Licking County

- Union County

Help Protect Your Business With State Farm.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all on your own. State Farm agent Katie Rider, a fellow business owner, understands the responsibility on your shoulders and is here to help you customize a policy that's right for your needs.

One of Columbus’s top choices for small business insurance.

Cover all the bases for your small business

Protect Your Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a florist or a lawn care service or you own a bagel shop or a vet hospital. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Katie Rider. Katie Rider is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

It's time to contact State Farm agent Katie Rider. You'll quickly learn why State Farm is one of the leaders in small business insurance.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Katie Rider

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.